Summary

In this article I revisit the deteriorating fundamentals of Philip Morris.

The company's stock price has surged, but its financial state continues to paint a different picture.

At an all-time high P/E ratio, the stock has not yet priced in the company's increasingly precarious financial state.

My first ever article on Seeking Alpha discussed the possibility that Philip Morris May Cut Dividend, and I argued in it that the attractive yield was blinding investors even as lower unit sales led to revenue declines, exacerbated by a substantial increase in excise taxes paid, which led to unsustainable debt levels to finance the dividend payments.

One year after my article, and two days before the company's next quarterly earnings announcement, it's time for a postmortem.

Following a dip the stock has risen

In the five months following my article, Philip Morris' stock (PM) dropped by more than 12% to $87 per share, but since then has increased quickly by 36% to more than $120 per share.

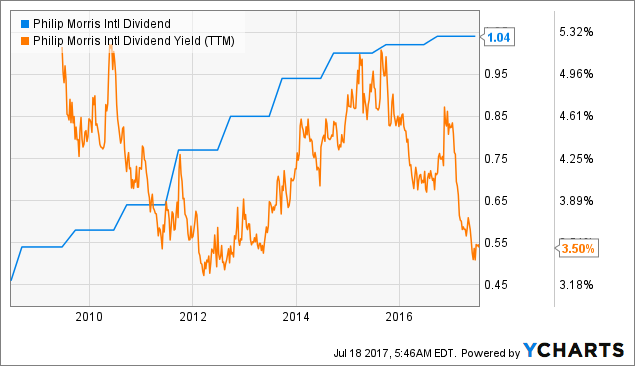

Dividend increased slightly

Continuing with the slowed down increases, the company upped its dividend by only 2 cents per share, for a second year in a row, frustrating some investors. Since the stock price has increased in the meantime, the company's dividend yield (dividend paid as a percentage of stock price) is now near all-time lows.

PM Dividend data by YCharts

PM Dividend data by YCharts

Last year's dividend increase, as small as it was, was again financed by debt.